Surviving in America requires sufficient finances to develop yourself and your family. When you do not have these finances available, you may have to seek loans from lenders. One of the components they will need is your credit report.

A credit record is an essential document that your potential employers, landlords, and even certified lenders will use to ascertain your creditworthiness. An excellent credit report can provide positive outcomes for you and your family.

This article explores what credit reports are, their components, their importance, how to obtain them, and how to build credit fast.

What Is a Credit Report?

A credit report is a document that provides a detailed record of your credit history, such as your credit account, payment history, debt history, credit score, credit inquiries, and other information. This report is particularly important because certified lenders review it when you apply for credit cards, business loans, and paying for mortgage, tuition, or car loans.

Your credit report and score determine your creditworthiness – the ability to repay your loans – and allows them to make informed decisions to approve or decline your request.

You can only have one credit report, even with multiple credit accounts.

Importance of the Credit Report

Your free credit report comes with many benefits. They include:

- Quick access to credits and loans. An excellent credit report can make it quicker for you to secure credit cards, loans, business lines of credit, and other forms of credit.

- Lower interest rates. You can also be eligible for lower interest rates, significantly saving you money on repayment.

- Job opportunities. Your potential employer may check your credit score and report as part of the recruitment process. A good credit report sends a signal that you are reliable and responsible.

- Better rental options. With an excellent credit report, you can secure better apartments, as your landlord will be confident that you will pay your rent without issues.

- Higher credit limits. A good credit report and score can give higher credit limits on your credit cards.

- Insurance premiums. You typically get lower insurance premiums when you have a good credit report.

- Peace of mind. A good credit report can give you peace of mind because you know you’re in good financial standing.

Components of a Credit Report

The information that is displayed on your credit report includes:

- Personal information. This includes your name, date of birth, Social Security Number, current and past home addresses, phone numbers, and past employers.

- Accounts. This includes a comprehensive list of your credit accounts, credit cards, installment loans, creditor names, balances, payment history, balances, and account status.

- Public records. This part may include if you’ve ever filed for bankruptcy or not.

- Recent inquiries. This section shows those who have recently asked to view your credit information.

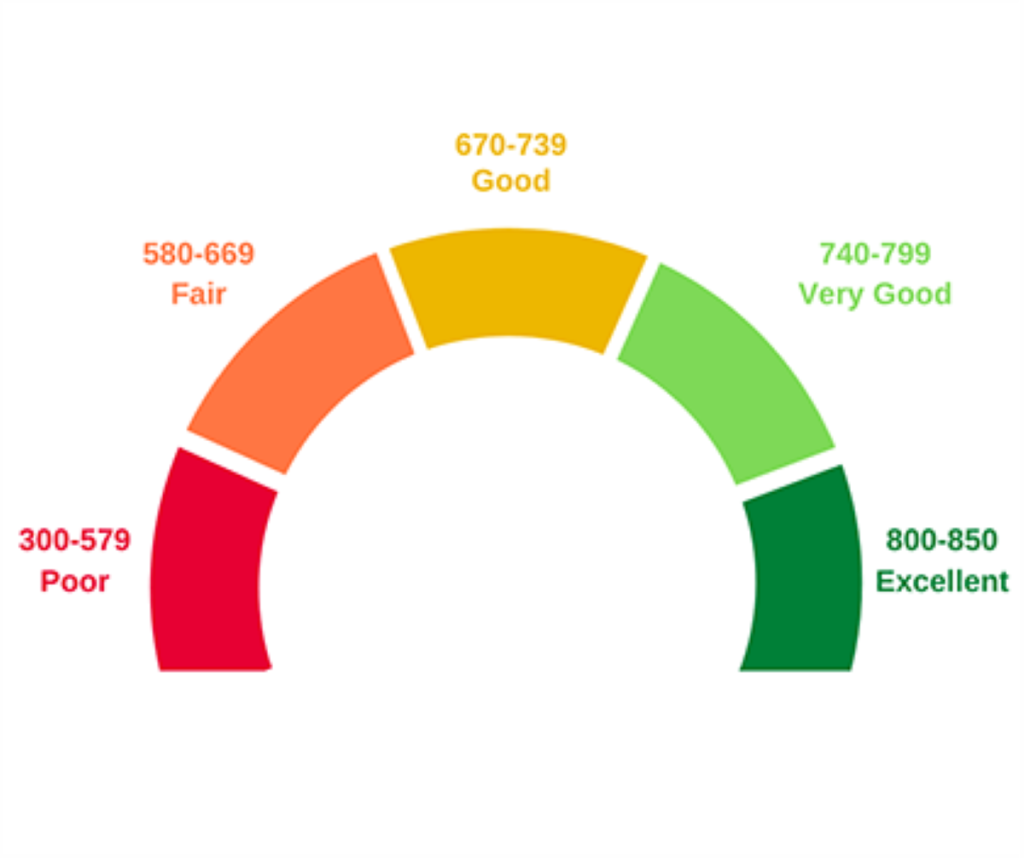

- Credit score. This is a score of your creditworthiness. It ranges between 300 to 850.

How To Obtain Your Credit Report

If you’re thinking ‘how do I get my credit report immediately?’ here are your options:

- You can visit Annual Credit Report to request a free credit report

- You can visit any of the three credit reporting agencies (Equifax, Experian, and TransUnion)

- You can also get a free credit report from credit karma by registering at the website

- You can also call 1-877-322-8228. For TTY service, call 711 and ask the relay operator for 1-800-821-7232

- You can also request your credit information by completing the Annual Credit Report Request Form and mailing it to:

Annual Credit Report Request Service

PO BOX 105281

Atlanta, GA 30348-5281

If you want to check your report multiple times, you’d have to subscribe to any of their monthly plans.

What Are Credit Scores?

A credit score is a number that is used to rank your creditworthiness. It helps your creditors, landlord, or employer to rate your reliability. Thus, the scores decide the terms they are willing to offer.

An excellent credit score can help you secure better loans, rent an apartment, and lower your insurance premiums. Credit scores are between 300 to 850, ranked in the following ways:

Your credit score may differ depending on the credit reporting bureau displaying them. However, the figures won’t be far off.

Factors That Influence Your Credit Score

Several factors influence your credit score. They include:

- Payment history. Paying your bills on time is crucial, making up 35% of your credit score. Missing your payments may significantly impact your credit score.

- Amounts owed. Another essential factor is the total debt you owe compared to your available credit. It is also known as your credit utilization ratio, as it makes up 30% of your credit score.

- Length of credit history. This is how long you have been receiving and repaying credits. It contributes 15% to your credit score.

- New credit. Opening a new credit account impacts your credit score. However, the impact is limited to 10%.

- Credit mix. This is the diversity of your various credit accounts, showing your creditors that you can handle your debts accordingly. It contributes 10% to your credit score.

How to Improve Your Credit Score

Practice these tips to build credit fast and enjoy the best deals with lenders:

- Pay your bills on time

- Keep your credit utilization low. Ensure you only make use of your credit cards for important spending. Most experts recommend using less than 10% of your available credit.

- Start using credit early, as it would ensure that you have a credit history

- Slow down spending on new credit cards

Take Control of Your Credit

Your credit report and score reflect your financial responsibility and creditworthiness. Maintaining a good credit report is beneficial for accessing credit, landing better job opportunities, securing better apartments, getting a mortgage, and many more.

Checking your credit report can allow you to take stock of your creditworthiness and help you to negotiate better deals. More so, it can help you achieve your financial goals seamlessly.

For more information on federal and state benefits you may be eligible for, visit our website.