The minimum wage acts as a fundamental pillar for establishing the baseline compensation that employers are legally required to offer their workers. Understanding it can allow employers and employees alike to strive for an equitable wage framework and promote economic prosperity on all fronts. This comprehensive article aims to explore what the minimum wage is in 2023 in the US, how it is calculated, and what you need to know to make sure you are receiving the salary you deserve.

What We Mean by Minimum Wage

The minimum wage is the legally mandated lowest hourly rate employers must pay their employees. It serves as a safeguard to ensure that workers receive a fair and reasonable level of compensation for their labor.

In the United States, the minimum wage is determined either at a federal level by government bodies or at the individual state level. Its primary objective is to establish a basic standard of living for employees, offering protection against exploitative practices. By setting a floor on wages, the minimum wage helps prevent excessively low pay that can lead to financial hardship for workers.

Difference Between Net and Gross Salary

There’s a huge difference between net and gross salary. Here’s an explanation:

| Gross Salary | Net Salary |

| This is the total amount of compensation you receive before deductions are taken out. Thus, it includes your base pay and other components such as commissions, bonuses, allowances, and overtime pay. | Also known as take-home pay, net salary is the money you receive after deductions such as taxes, health insurance, retirement, and social security contributions. In other words, this is the exact money you receive at the end of the month or paycheck. |

The minimum wage sets the groundwork for how much an employer will pay an employee for hours worked. In this case, the gross salary will be calculated by multiplying the minimum wage by the number of hours worked. However, the net salary an employee takes home will be determined by different factors, such as tax rates, deductions, and exempted – which can vary from one person to another.

It is also important to note that minimum wage does not directly dictate an individual’s gross or net salary unless they are earning exactly the minimum wage. This is because some employees earn more than the minimum wage based on factors such as their skills, experience, and the industry they work in.

How Is Minimum Wage Calculated?

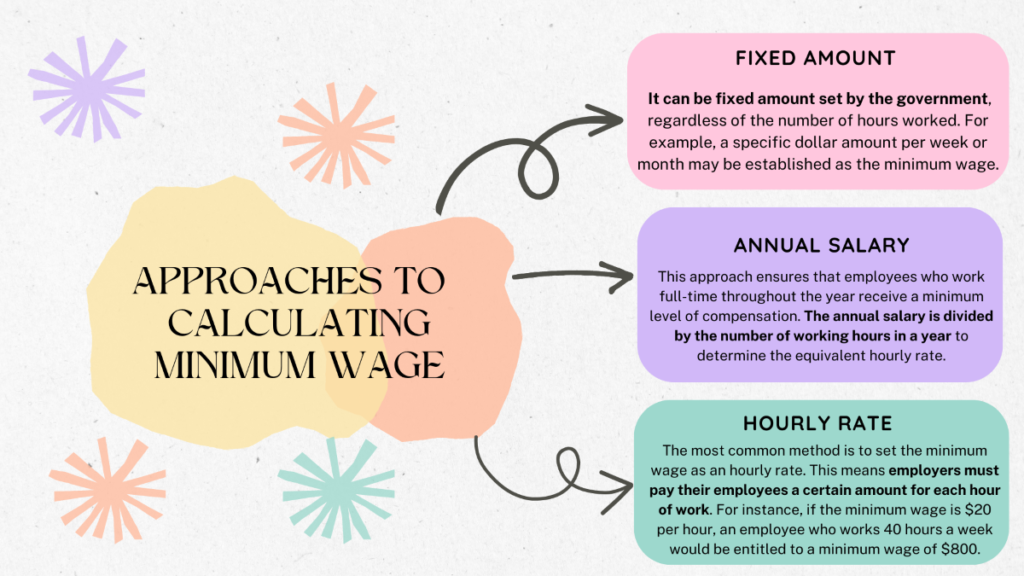

Minimum wage calculation varies depending on the jurisdiction and specific regulations in place. Some of the common approaches used to calculate the U.S. minimum wage include the following:

Additionally, several factors influence the establishment and adjustment of minimum wage rates. They include the following:

Cost of Living

The cost of living is a fundamental consideration when determining the minimum wage. Higher living expenses in certain areas may necessitate a higher minimum wage to ensure that workers can meet their basic needs and maintain a decent standard of living.

Labor Market Conditions

The state of the labor market, including factors like unemployment rates, labor demand and supply, and overall economic conditions, can influence the minimum wage. In a tight labor market with a high demand for workers and low unemployment, minimum wage rates may increase to attract and retain employees.

Inflation and Consumer Price Index (CPI)

Inflation, which reflects the general increase in prices over time, can erode the purchasing power of wages. To account for this, minimum wage rates are often adjusted periodically to keep pace with rising prices.

Social and Political Factors

Public sentiment, social equity considerations, and political dynamics can impact minimum wage in US yearly decisions. Advocacy by labor unions, worker organizations, and social justice movements can influence the push for higher minimum wage rates

What Is the U.S. Federal Minimum Wage in 2023?

The federal minimum wage in the U.S. per hour is $7.25. However, some states have higher minimum wages than the federal government. You can see the full list by clicking this link.

What Happens If You Receive Tips as Part of Your Salary?

Receiving tips as part of your salary can affect your overall compensation and your wage. There are a few points to consider:

Tip Credit

According to the Fair Labor Standards Act (FLSA), employers can take a tip credit towards meeting the minimum wage requirement. This means employers can pay tipped employees a lower cash wage if the cash wage and tips received exceed or equal the minimum wage.

Tip Pooling

Some establishments may implement tip pooling, collecting and redistributing tips among employees, such as servers, bussers, and bartenders. The specifics of tip pooling arrangements can vary depending on state and local laws.

Overtime

Tipped employees are entitled to overtime pay if they work over 40 hours in a workweek. The overtime pay rate is typically calculated based on the regular hourly wage rather than the lower-tipped wage.

How Does Minimum Wage Affect Social Benefits?

U.S. minimum wage has implications for social benefits and assistance programs. For instance, you may be eligible for Medicaid, SNAP, TANF, subsidized housing, and subsidized internet if your salary meets the income threshold for eligibility.

What Can You Do If You Receive Less Than the Minimum Wage?

If you find yourself receiving less than the minimum wage, there are steps you can take to address the situation. It includes:

- Have a conversation with your employer or H.R. manager, and share your concerns

- Research state labor laws in your state of residence

- If your employer or H.R. manager doesn’t resolve the situation, you can reach out to your state labor authorities

- Seek legal advice from an employment attorney

Take Control of Your Wages

The minimum wage in the United States serves as a vital mechanism for ensuring fair compensation, reducing income inequality, and supporting a decent standard of living for workers. It not only establishes a baseline for employee earnings but also has broader implications on eligibility for social benefits and assistance programs.

However, it’s important to acknowledge that gross and net salaries differ from the minimum wage due to factors like deductions, taxes, and individual circumstances, which impact the actual amount received by employees.

In the event of a minimum wage violation, it is advisable to initiate a dialogue with your employer. If that fails, we suggest you seek support from labor authorities or legal professionals to ensure your rights are protected and upheld.